Market Update: A quiet break from the new normal

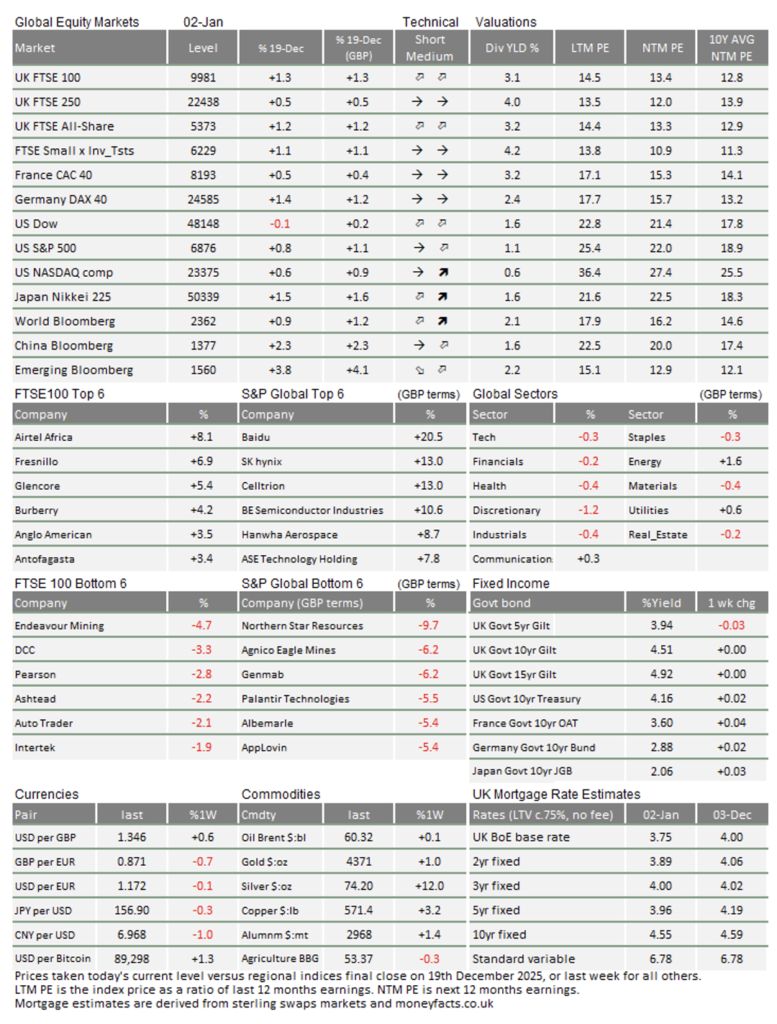

We have crossed from the old to the new year with a bit of cheer. While US equity markets have marked time, Europe’s broad market has hit a new high, and the FTSE 100 traded above 10,000 last week. China traded the first day of 2026 with a 2% gain.

For much of 2025, holiday periods and weekends were not restful for investors, given the Trump administration’s propensity to lob grenades into the room at any time. However, towards the end of the year, the approach appeared to change. In itself, this has been a subject of debate. Is this a planned change in policy approach? Is the President losing his remarkable energy, possibly because of worsening health?

Either way, market participants have welcomed a quiet and undramatic period. Having had a bout of rebalance profit-taking and volatility in November, investors appear to have set the main asset classes in portfolios as they would wish well before trading liquidity dried up. The drip of savings flow into equity markets has brought them back towards the highs of the year as some institutional investors put that money into the market each day. However, some prefer to wait for more liquid trading, causing a strong lift on this first day.

Bond markets were also quiet, after digesting the enormous size of US data-centre corporate bond issuance released in November and December. Bond price volatility has diminished substantially through the year although longer maturity yields remain elevated. More positivity about growth (especially in the UK and Europe) would generally mean that fixed income yields would rise. Offsetting this, inflation expectations have declined. This has been markedly so in the UK, where the expected average inflation rate for the next 10 years has dropped by 0.5%, from 3.1% to 2.6%.

Precious metals powered through to December to Christmas eve. Since then, we’ve had sharp swings amid some speculator repositioning and reduced trading liquidity. Platinum and palladium have seen meaningful corrections but silver is keeping much of the month’s gains. Gold had a period of mild gains but the more useful metals seem to be doing better (and silver is a very useful in all sorts of tech). Gold has been supported by global investors seeking safe assets but growth positivity is on the rise, and many expect 2026 to be more stable than 2025. Trump and his administration will probably seek less confrontation if the Republicans are to build support from current low approval ratings into the mid-terms.

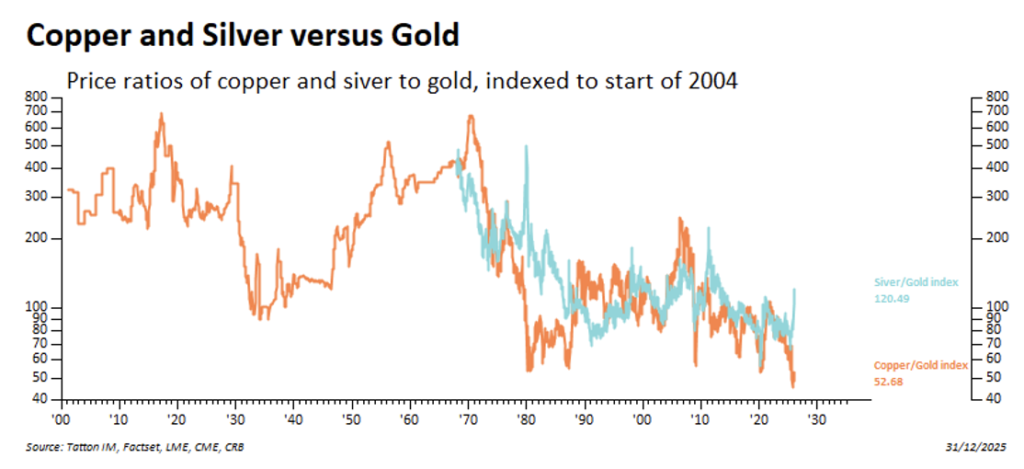

Copper has hit all-time highs in US dollar terms but, when measured against precious metals, it looks cheap, as the graph below shows. Oil is even cheaper.

Industrial metals have shown resilience in the last past of this year. Many analysts are still quite negative on oil but, if economic growth positivity is justified, we could see energy and industrial commodities on the rise in 2026.

It may have been a quiet holiday for markets but the 2025’s “new normal” is likely to be 2026’s “not-so-new normal”. Last year’s talking points are set to be revisited in the coming weeks.

In the UK, the economy is growing fast enough to keep the equity market and sterling stable to strong, but slow enough to keep inflation heading towards the 2% target and interest rates on a downward path. This will not be enough to keep the Labour leadership safe as we head towards the May local government elections, so they will seeking stronger growth-oriented policy initiatives and deregulation is the most likely area. Meanwhile, the Conservatives are finding their mojo with a policy agenda based on welfare state reduction. If political debate is focussed on economics and turns away from identity and culture, investors will be happy.

The possibility of peace in Ukraine has risen marginally, not because of political efforts but because the Russian economy has finally started to weaken. While oil price weakness is a part of this, the Russian government finances are becoming exhausted. Europe nations are improving defences as governments remain committed to increased spending. Despite Putin’s tough talk, things are more difficult for him.

Europe’s defence spending will support industry although firms remain under pressure from Trump’s tariffs and may face more bad news if the tariff regime is upset again. Meanwhile, Europe’s Banks have been a big outperformer in 2025 with gains of over 60% and JP Morgan still sees further upside amid an improving economy. The European Central Bank (ECB) expects domestic demand to remain the main driver of growth, supported by rising real wages and a resilient labour market. With inflation under control and close to the target, the ECB is expected to keep monetary policy stable and allow bank lending to rise.

The 2025 Q4 earnings season kicks off in a fortnight with US major banks reporting. Earnings growth was the main driver of stock performance in 2025 after tech valuations peaked and started to fall back. Still, artificial intelligence remains the most discussed theme, and new large-language-model releases are expected in the next three months.

Trump is expected to name a successor to Jerome Powell for the Fed Chair next week. Hassett remains the most likely successor. Markets are pricing only a 20% chance of a cut at the January 28th meeting as the decision making committee awaits more data. That might change if Trump attempts to unseat Powell before the end of his term on 15th May.

The US Supreme Court will rule on the tariffs imposed under the emergency powers act (the IEEPA) ruling early next year, with decision in either direction adding uncertainties. The US will use other measures to recreate $200B in tariff revenues if struck down but they are not so straightforward. In particular, bond investors will worry that the tariff revenues could be reduced, worsening the government deficit again and potentially pushing yields up (and, therefore, pushing down bond prices).

The US Congress adjourned for the holidays with nine government funding bills needing to be passed and the House of Representatives still has to vote on a three-year extension of the Affordable Care Act. The Republicans have not yet finalised alternative proposals and, clearly, nothing is agreed with the Democrats. The US government will shut down again on January 30th if they do not progress fast enough.

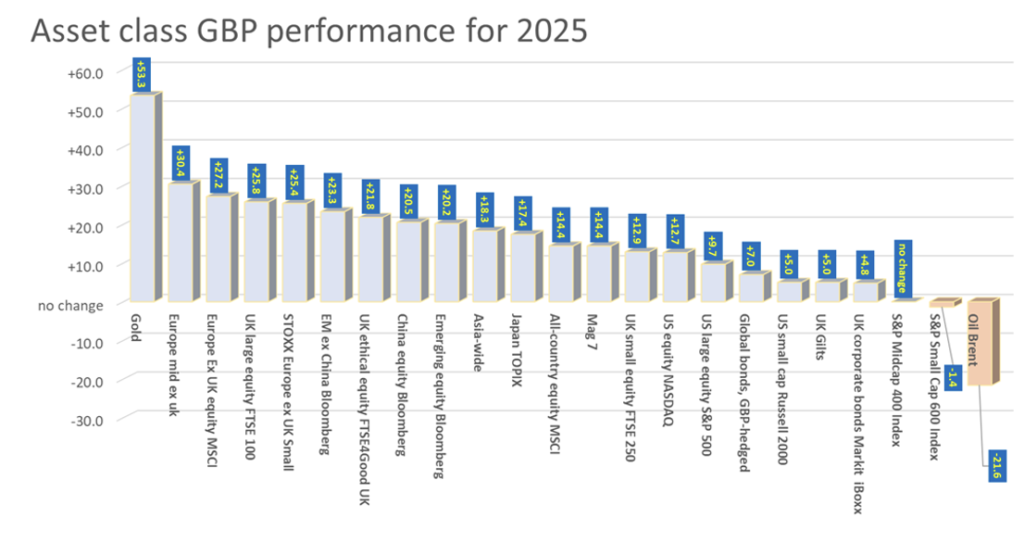

We will give a more detailed review of asset and sub-asset class performances for 2025 in next week’s missive. In the meantime, we show many of the year’s sterling-based returns , ranked from best to worst. A very Happy New Year to all of you!

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.